CS001 - Computer Proficiency License

Question(s) similar to the following:

Explain how and why the components of aggregate demand depend on the real interest rate. Be sure to distinguish between the real and nominal interest rates, and explain why the distinction matters.

Question 1: Explain how and why the components of aggregate demand depend on the real interest rate. Be sure to distinguish between the real and nominal interest rates, and explain why the distinction matters.

Answer: Suggest Edit

It is helpful to think of aggregate demand as having two parts, one that is sensitive to real interest rate changes and one that is not Investment is the most important of the components of aggregate demand that are sensitive to changes in the real interest rate.

Output (Y)

Inflation (?)An investment can be profitable only if its internal rate of return exceeds the cost of borrowing Consumption and net exports also respond to the real interest rate;

Consumption decisions often rely on borrowing, and the alternative to consumption is saving (higher rates mean more saving).

As for net exports, when the real interest rate in a country rises, her financial assets become attractive to foreigners, causing local currency to appreciate, which in turn means more imports and fewer exports (lower net exports)

While changes in real interest rate may have an impact on the government's budget by raising the cost of borrowing, the effect is likely to be small and ignorable.

Similar Questions:

Question 2: Explain how and why the components of aggregate demand depend on the real interest rate. Be sure to distinguish between the real and nominal interest rates, and explain why the distinction matters.

Answer: Suggest Edit

It is helpful to think of aggregate demand as having two parts, one that is sensitive to real interest rate changes and one that is not Investment is the most important of the components of aggregate demand that are sensitive to changes in the real interest rate.

Output (Y)

Inflation (?)An investment can be profitable only if its internal rate of return exceeds the cost of borrowing Consumption and net exports also respond to the real interest rate;

Consumption decisions often rely on borrowing, and the alternative to consumption is saving (higher rates mean more saving).

As for net exports, when the real interest rate in a country rises, her financial assets become attractive to foreigners, causing local currency to appreciate, which in turn means more imports and fewer exports (lower net exports)

While changes in real interest rate may have an impact on the government's budget by raising the cost of borrowing, the effect is likely to be small and ignorable.

Past Papers of CS001 - Computer Proficiency License

Question 1: Explain how and why the components of aggregate demand depend on the real interest rate. Be sure to distinguish between the real and nominal interest rates, and explain why the distinction matters.

Answer: Suggest Edit

It is helpful to think of aggregate demand as having two parts, one that is sensitive to real interest rate changes and one that is not Investment is the most important of the components of aggregate demand that are sensitive to changes in the real interest rate.

Output (Y)Inflation (?)

An investment can be profitable only if its internal rate of return exceeds the cost of borrowing Consumption and net exports also respond to the real interest rate;

Consumption decisions often rely on borrowing, and the alternative to consumption is saving (higher rates mean more saving).

As for net exports, when the real interest rate in a country rises, her financial assets become attractive to foreigners, causing local currency to appreciate, which in turn means more imports and fewer exports (lower net exports)

While changes in real interest rate may have an impact on the government's budget by raising the cost of borrowing, the effect is likely to be small and ignorable.

Similar Questions:

Question 2: Explain how and why the components of aggregate demand depend on the real interest rate. Be sure to distinguish between the real and nominal interest rates, and explain why the distinction matters.

Answer: Suggest Edit

It is helpful to think of aggregate demand as having two parts, one that is sensitive to real interest rate changes and one that is not Investment is the most important of the components of aggregate demand that are sensitive to changes in the real interest rate.

Output (Y)Inflation (?)

An investment can be profitable only if its internal rate of return exceeds the cost of borrowing Consumption and net exports also respond to the real interest rate;

Consumption decisions often rely on borrowing, and the alternative to consumption is saving (higher rates mean more saving).

As for net exports, when the real interest rate in a country rises, her financial assets become attractive to foreigners, causing local currency to appreciate, which in turn means more imports and fewer exports (lower net exports)

While changes in real interest rate may have an impact on the government's budget by raising the cost of borrowing, the effect is likely to be small and ignorable.

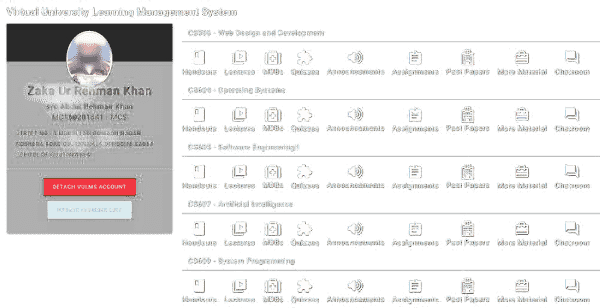

Our VULMS adds features of MDBs and lets your populate VU subjects automatically.

Try our 3 days free demo now! Online online holy quran tajweed classes are useful to learn reading holy quran with tajweed.

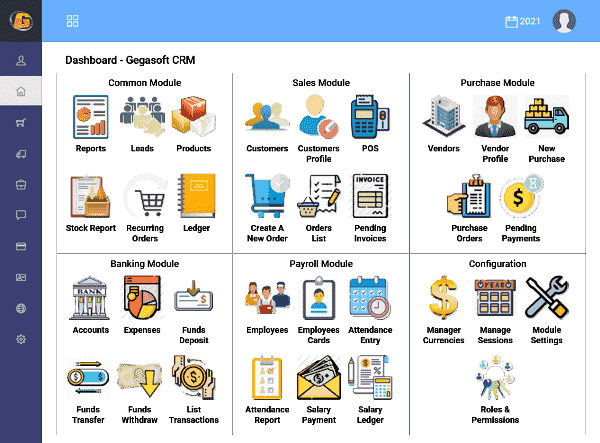

Gegasoft Point of Sale/Customer Relationship Management software is an accounting software to fulfill your business needs.